$25 Billion: The Price Tag For Repealing 45Y And 48E Tax Credits

Taking tax credits away from Americans will raise household energy bills

Congressional efforts to slash federal spending to pay for trillions in extended tax cuts have homed in on an ironic target – policies that are already cutting energy costs for families across the country.

The aptly named Inflation Reduction Act, passed by Congress in 2022, has taken on new importance as the Trump administration levies tariffs on nearly every country that exports goods to the United States, threatening to spike costs for the commodities Americans use in everyday life.

While 21 House Republicans and four Senate Republicans have lobbied their party to protect clean energy tax credits for economic reasons, a joint resolution in the U.S. Senate seeks to repeal the 45Y clean electricity production credit and 48E clean electricity investment credit – collectively known as the technology-neutral electricity tax credits - while a bill proposed in the House would phase them out.

An Energy Innovation meta-analysis reveals repealing 45Y and 48E would force Americans to pay $6 billion more in annual electricity bills by 2030, soaring to $25 billion annually by 2040.

Other independent analysis shows these two tax credits could protect Americans from inflation hitting their energy bills: Brattle Group analysis for the right-leaning group ConservAmerica estimates 45Y and 48E are worth $51 billion in annual consumer electricity costs by 2035, and NERA Economic Consulting says they’re preventing a 6.7 percent electricity price increase in 2026 and 7.3 percent increase in 2029.

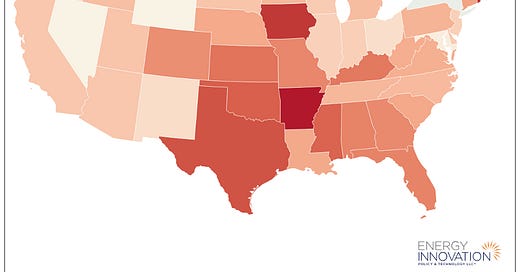

Households in some states would have to pay more than $500 annually in higher costs. That’s a tough tab to pay considering roughly a third of U.S. households had to forego basic necessities to pay energy bills in 2023.

Inflation is hitting energy bills hard for American families and businesses. They increased 22 percent from 2018 to 2023, and could rise another 7 percent this year – or more, if gas prices rise more than 90 percent by 2026, as estimated by the U.S. Energy Information Administration.

A nationwide survey reveals more than half of Americans worry they won’t be able to afford their electricity bills in 2025. With costs already elevated by inflation, and potentially rising even more due to tariffs, our families and businesses simply can’t afford another hit to their budgets.

IRA provisions are a hedge against rising energy bills, in addition to generating $600 billion in private investment across our country.

Congress now has 25 billion more reasons to protect federal clean energy tax credits.