The “Big Beautiful Bill” Will Reverse 75 Years of Falling Electricity Prices

How the "big beautiful bill" will cost Americans jobs and cheaper electricity

“Only within the moment of time represented by the present century has one species – man – acquired significant power to alter the nature of the world. ”-Rachel Carson

Scientist Rachel Carson wrote those words 63 years ago in her famed book, Silent Spring. Yet the words ring true today more than ever, as policymakers now wield the power to change the world with the stroke of a pen – for better or worse.

The just-passed “One Big Beautiful Bill Act” (OBBBA) ushers in a new era of American climate policy by repealing clean energy incentives, delaying conservation funding, subsidizing coal, and prolonging the United States’ oil and gas dependency. OBBBA threatens a safe climate future while worsening energy price inflation, squeezing families already struggling to pay bills, and ceding AI leadership and manufacturing jobs to our biggest economic competitors.

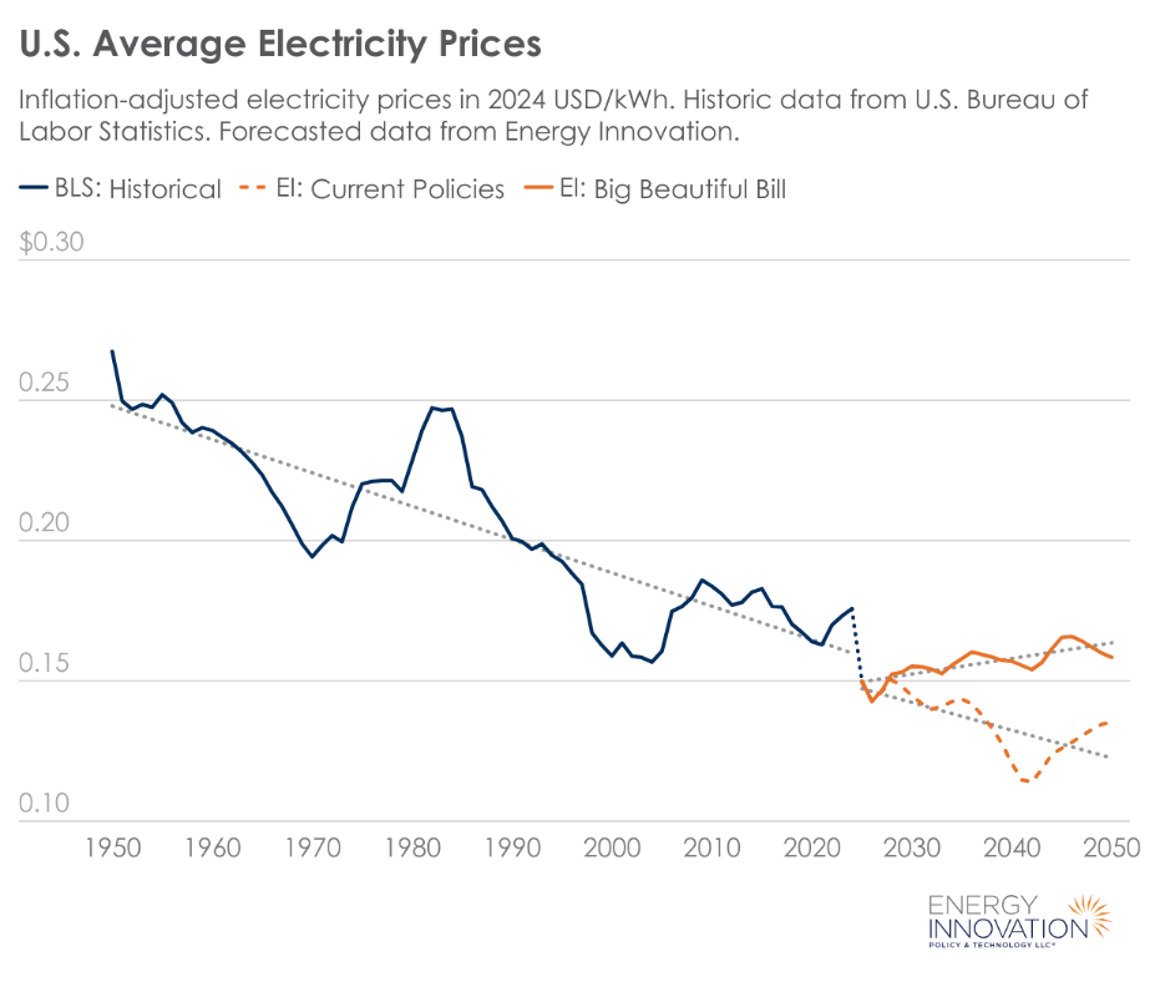

Much of America’s recent economic growth has been driven by 75 years of ever-cheaper electricity prices that have powered manufacturing, helped families make ends meet, and created jobs. But OBBBA will throw all of that in reverse and increase power prices for households, businesses, and manufacturers across the country.

Here’s how the bill will alter America’s economy and energy system over the next decade.

Power-hungry AI hippos

The Trump administration’s megabill arrives as the world starts a race to win the AI boom: advanced new chips make AI a promising tool for practical applications, and countries are fiercely competing to lead this technological revolution, with many believing the winner will emerge as a global superpower.

However, AI computing and the data centers that host it consume vast amounts of energy. A single text query can consume 0.2 to 2 watt-hours, or as much as a few minutes’ use of an LED light bulb. But more complex queries, for example making an AI-generated short film, can consume over 100,000 watt-hours, enough energy to drive my fully loaded Hyundai electric vehicle – dog and all – from Washington, D.C. to Boston.

Companies face a quandary as they try to site new data centers: how can they supply AI’s voracious appetite for electrons? Orders for new gas turbines are backlogged through at least 2029 and tech giants are scrambling to secure power, signing purchase agreements for new renewables and existing fossil fuel and nuclear plants.

But existing plants can only provide limited power without increasing prices. New wind and solar plants are the only low-cost way to meet new demand in the near term. OBBBA’s new policies will strangle utilities’ ability to get those plants online.

Meeting surging power demand

This bill repeals tax credits that incentivize developers to invest in domestic energy; the biggest losers are wind and solar.

Energy Innovation’s analysis of the bill shows it stifles private investment in our electricity system; developers will lose 340 gigawatts (GW) of new power capacity in the next decade because of the bill, or approximately one third of what was otherwise expected over that time period. For context, America’s entire power grid had around 1,300 GW installed capacity at the end of 2024.

Without new, low-cost renewables, inefficient fossil plants will instead run for longer hours, driving generation costs higher. Increased gas demand will outstrip America’s ability to increase production, so natural gas prices will go up in tandem. And coal power costs increased 28 percent from 2021-2024, costing consumers billions.

Combined, these implications lead to one big, ugly outcome: higher power prices. Coming off a post-COVID inflation spike, energy costs are on everybody’s minds in the U.S. – 34 percent of U.S. households had to cut back or skip necessary expenses in the past 12 months to pay energy bills.

But what would higher power prices mean for the country?

Over the last century, power prices have acted like the stock market – quite volatile in the short term, but reliable over the long term. Since 1950, the inflation-adjusted price of electricity has fallen around 1.2 cents per kilowatt-hour (¢/kWh) each decade. Over a 75-year span, that’s about a 35-percent decrease.

In a world without OBBBA, this trend would continue. Our analysis forecasts residential power prices would continue falling around 1 ¢/kWh each decade as new, low-cost renewables plug into the grid and produce energy without any fuel costs.

But this bill upends that near century-long trend. By disincentivizing new investment in the electricity system, the government is stifling what could have been a prosperous American energy market. Utilities won’t be able to keep up with the country’s AI-driven power demand, so prices will balloon.

The analysis estimates households will see sustained increases in the price of electricity over several decades – about 0.6 ¢/kWh each decade – for the first time since the energy crisis of the 70s and 80s.

In turn, it’s likely several tech giants will site data centers in other countries with cheaper, more reliable electricity.

Implications for families and business

0.6 ¢/kWh sounds like a small increase, but what does it mean in terms of everyday life? Three things: higher utility bills, a wounded job market, and squandered American energy independence.

Higher power prices are the main reason Americans will face bigger home energy bills. All states will suffer, but folks will feel this burden most acutely in particular parts of the country: Annual household energy bills will balloon by over $600 in states like South Carolina, Kentucky, and Missouri. These states will face dwindling support for renewables and heavy reliance on increasingly expensive natural gas generation due to the bill.

On the other hand, families in the Northeast U.S. will be comparatively sheltered from the bill’s impacts, facing price increases of under $200 per year. These consumers are in part protected by state-level renewables standards, which require utilities to continue investing in clean electricity, ameliorating the impact of skyrocketing fuel costs. That said, every dollar in higher energy bills is a dollar less in our pockets.

OBBBA will also damage our labor market. Across the country, falling energy deployment means lost jobs and lands significant blows on U.S. manufacturing as demand for goods falls and factories are offshored. American workers could lose 760,000 by 2030. These job losses will be felt most acutely in states with burgeoning manufacturing and solar deployment sectors like Florida, Ohio, and Arizona.

As factories shut down and companies offshore jobs to competitor countries with lower energy costs, U.S. economic output will shrink. We forecast a $980 billion loss of GDP in the budget window through 2034 with the biggest losses in states with manufacturing and energy investments from the Inflation Reduction Act of 2022, especially California, Texas, Indiana, Florida, Georgia, and North Carolina.

Moving forward

OBBBA’s repercussions will be felt far and wide across the nation. For most people it’ll appear as higher gas prices, higher household bills, and volatile energy markets that could have been and could still be solved by building out more renewables.

The Big Beautiful Bill is not beautiful. What it means for America is higher inflation, lost jobs, and damaged economic competitiveness. That’s an ugly outcome for our country and our workers.